A Human Guide to the System Behind the System

Table of Contents

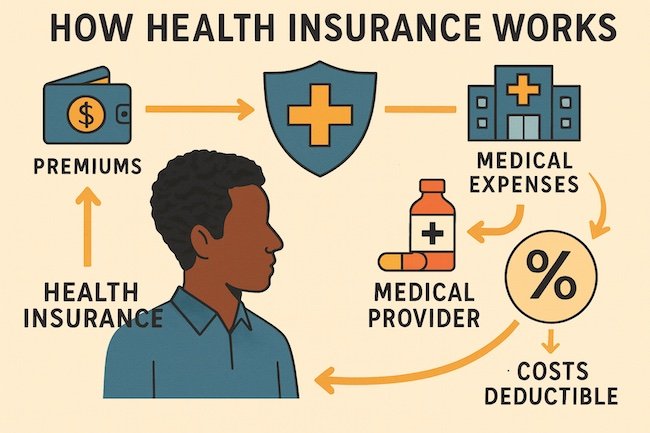

Here’s how health insurance works in real life, and why the system feels so confusing until you understand its hidden rules. Most people think insurance is the thing you hand over at the doctor’s office so you don’t have to pay full price. And in a loose sense, that’s true. But that’s not how it actually works. Health insurance is not a payment method. It is a second healthcare system layered silently on top of the first one.

It determines what care you’re allowed to receive, what you pay for it, which doctors you can see, which hospitals are “in,” which are “out,” which medications are approved, and which procedures require a blessing from someone you’ll never meet.

If healthcare already feels confusing, insurance is the reason it often feels impossible. This guide explains the entire process clearly, honestly, without jargon, and without pretending the system is simpler than it actually is. Let’s pull back the curtain, shall we?

1. Insurance Doesn’t Pay for Everything. It Negotiates Everything.

People assume insurance “covers” care.

However, in reality, insurance is a negotiation for the price of care.

Before you step into a doctor’s office, your insurer has already struck a deal with that clinic:

- A negotiated price for each service

- A reimbursement structure

- A set of rules for what is “medically necessary”

- A contract that decides whether you can even go there

That is why the same MRI can cost $350 at one facility and $3,200 at another. The machine is the same. The scan is the same. The difference is the contract.

If you think healthcare insurance is about medicine, you’re in for a rude awakening. It’s about money, contracts, and networks.

2. The Network Is the Real Map (Not the Insurance Card)

Your insurance card tells you almost nothing.

The important part is something you rarely see: the provider network.

“Network” means:

The list of doctors and hospitals your insurer has negotiated with.

That determines:

- who you can see

- how much you pay

- whether your care is denied entirely

It is entirely possible to have “great insurance” and still get stuck with:

- a $900 bill for an out-of-network lab

- a $300 urgent care visit

- a medication that “isn’t covered” unless you change to a cheaper one

- a specialist who won’t accept your plan

Your experience depends on the network, not the brand name on the card.

3. Deductibles, Copays, and Coinsurance: Three Ways of Saying “You Pay First”

These terms confuse everyone, but they boil down to one truth:

Most insurance plans are designed so you pay a significant amount before they do.

Here’s the plain-English version:

Deductible:

What you must pay first before insurance pays anything meaningful.

Copay:

A flat fee (ranging from $30 to $60) that applies to basic visits — only certain services are included.

Coinsurance:

Your percentage of the bill after the deductible is met. Often 20–40%.

So a typical path looks like this:

- You pay full price until your deductible is met.

- Then you pay a percentage (coinsurance).

- Then insurance covers the rest.

- Unless something is “not covered,” in which case you pay it all.

Health insurance is not designed to be intuitive. And it becomes clear once you realize that the system exists for cost-sharing, not simplicity.

More Health Guides You Might Need Next

4. Prior Authorization: The Hidden Gatekeeper

Prior authorization is the part nobody warns you about.

Even if:

- your doctor recommends the treatment

- it’s medically necessary

- it’s clearly documented

- everyone agrees it’s the right step

Your insurance company still reserves the right to delay or deny coverage.

Prior authorization is the insurer’s way of saying:

“Prove to us that this care is worth the cost.”

Doctors hate it. Patients hate it. But insurers rely on it to control spending.

If you’ve ever wondered why care feels slow, fragmented, or full of hoops, this is one of the biggest reasons.

5. The Explanation of Benefits (EOB) Is a Drama Recap

The EOB is the most misunderstood part of the system. It looks like a bill, feels like a bill, and scares people like a bill. But it’s not a bill. It’s a recap of the negotiation between your provider and your insurance.

It outlines:

- what the clinic charged

- what insurance allowed

- what insurance actually paid

- what’s left for you

Only the final line matters: “You may owe.” Everything above it is backstage math.

6. The Cash Price Secret (Your Insurance Might Be the Most Expensive Option)

While it might feel counterintuitive, the “cash price” is often:

- simpler

- lower

- and faster than using your insurance

Why would the uninsured patient pay less?

The cash rate is often the actual cost, and contract terms, administrative costs, and claim submissions can all contribute to inflating the insurance rate.

If you’ve ever wondered why urgent care asks, “Are you using insurance today?” that is why.

In many cases, paying cash avoids:

- out-of-network penalties

- prior authorizations

- lab surcharges

- facility fees

- multi-month paperwork cycles

That isn’t advice, just reality.

7. You Are Allowed to Ask Questions

That is the part most people forget.

You are allowed to ask:

- Why is that the price?

- Is there a cash rate?

- Is this in-network?

- What happens if I wait?

- Is there a cheaper setting for this test?

- What exactly am I being billed for?

- Can you reprocess this claim?

The industry has conditioned people to be quiet, compliant, and confused. Your questions might seem inconvenient, but they are necessary. And they can save you from bills that were never supposed to exist in the first place.

A Final Thought on How Health Insurance Works

Health insurance isn’t confusing because you missed a class in school. It’s confusing because it operates according to rules that most people never get to see.

The moment you understand those rules, the entire experience becomes less intimidating; the vocabulary becomes decipherable, the paperwork becomes navigable, and the confusion becomes manageable.

You don’t need to master every detail; you need a clear map of the landscape. Once you understand how health insurance works, the system becomes far easier to navigate.

If you want to understand the bigger picture behind all this, read Why Is Healthcare So Confusing? A Human Guide to Navigating the System, it breaks down the structural issues that make the entire system feel overwhelming.

Related How I Search Links

- How I Search for Peace Online (algorithmic noise vs real-world noise)

- How I Search for Truth When Everything Feels Biased

- How I Search for Privacy Online (system complexity parallels)

Covered California Healthcare Coverage

If you’re in California (like we are) and want a clearer view of your coverage options, Covered California offers a straightforward starting point for understanding plans, networks, and costs.