Adopt the financial freedom mindset. Change the way you think about money and what it can do for you, and your financial situation will improve more quickly.

Money worries are the biggest sleep disrupter for most people, researchers report. There are bills that keep piling up, savings accounts that never get full and dreams of a better life that seem out of reach. But here’s what most people don’t understand: when it comes to your bank account, your thoughts matter more than your paycheck.

How you think about money is the master controlling everything — how you earn it, spend it, save it and grow it. If you want a new result with your money, you need to have something other than the mental program that has been driving your decisions about money for years. In this article, we demonstrate to you how you can construct a way-of-thinking that will shift your relationship with money and give you access to REAL wealth.

No matter if you’re mired in debt, getting by paycheck to paycheck or simply looking to take your financial life to the next level, changing the way you think about money is a fine foundation for lasting change.

How Your Mindset About Money Is Keeping You Broke

The majority of people have unconscious money beliefs that limit their success with money. These beliefs originated in childhood, family experiences as well as society’s messages around money. They function as background programs, deciding matters without you even knowing.

Common limiting beliefs include:

- “Rich people are greedy”

- “Money is the root of all evil”

- “I’m just not a numbers person”

- “Money doesn’t grow on trees”

- “Rich people had lucky breaks I’d never catch”

These ideas form self-fulfilling prophecies. If you think money is bad, you will unconsciously repel it. If you think you’re bad with money, you won’t even make an attempt to learn more effective financial strategies. Your brain manufactures a reality that reinforces what you already believe, so that your life remains predictable and the same.

The Scarcity Trap

Those who deal with money problems in life tend to approach it from a scarcity mindset. This way of thinking finds scarcity everywhere: there’s not enough money, jobs or time. Scarcity thinking kicks your brain into survival mode, and it tends to make you rash with fear-based, short-term decisions rather than strategic, long-term choices.

Some of the things you do when you find yourself in scarcity mode include:

- Skip important investments in yourself

- Make desperate financial decisions

- Focus only on immediate needs

- Feel jealous when others succeed

- Store money rather than using it for strategic purposes

The Millionaire Mindset: How Your Thoughts Add Value To Your Life

Whereas those who have the freedom of money don’t simply have enough to pay the bills — they think totally differently. Studies show the wealthy have certain mental habits that help them to build and retain their wealth.

| Scarcity Mindset | Financial Freedom Mindset |

|---|---|

| “I can’t afford it” | “How can I afford it?” |

| Focuses on barriers | Focuses on possibilities |

| Spends first, saves what’s left | Pays themselves first |

| Believes money is scarce | Knows wealth can be created |

| Avoids financial education | Is always learning about money |

| Blames others | Takes responsibility |

| Working for money | Having their money work for them |

Abundance Thinking Changes Everything

The abundance mindset kicks off the financial freedom mindset. That doesn’t mean turning a blind eye to reality, or acting as if you’re wealthy when you aren’t. Abundance thinking acknowledges that opportunities are all around and you have the agency to add value.

People with abundance mindsets:

- See possibilities instead of limitations

- Invest in growth and education

- Share knowledge and resources freely

- Celebrate others’ success

- Take calculated risks

- Focus on value creation

Five Mental Shifts That Lead to Wealth

To reprogram your financial thinking, you need to make changes at a system level mental operating system. These five changes are the basics, fundamentals of leading a financially-transformed life.

Shift #1: From Consumer to Creator

Most people think of themselves as consumers: people who trade their time for money and then take that money to swap it for items. Money freedom thinking defines you as a creator – someone who creates value that other people are willing to pay for.

This reframe transforms the nature of your entire relationship with money. Instead of asking “What job can I get?” you want to know “What value can I create?” Instead of exchanging hours for dollars, you consider how to leverage skills, systems and others’ time.

Start practicing creator thinking:

- Notice problems you could solve

- Consider monetizable skills

- Look for gaps in the market

- Think of ways for capitalizing on your knowledge

- Ask what people need and want

Shift #2: Expense Paradigm to Investment Mindset

Bad money thinking treats money as something that drains out money from your wallet. The financial freedom mindset sees money as a tool that can compound.

That doesn’t mean every purchase needs to be deemed an “investment,” either — that’s simply mental gymnastics employed to rationalize spending. It is about critically examining whether the dollars spent today will bring more value tomorrow.

Real investments:

- Education that increases earning power

- Tools that improve productivity

- Health spending that maintains energy

- Networking that opens opportunities

- Assets that generate passive income

Expenses disguised as investments:

- Designer clothes “for your image”

- Luxury cars “for credibility”

- Expensive courses you never complete

- Get rich quick opportunities without any real work

Shift #3: Instant Gratification to Delayed Gratification

Delayed gratification is one of the largest predictors of financial success. So long as they’re working, people with the patience to wait for bigger rewards instead of grabbing small ones right now tend to accumulate wealth more quickly.

Your brain’s pleasure centers are activated when you spend money. Shopping high feels good but does not last long. The financial freedom mindset teaches your brain to derive pleasure from various sources—seeing your savings increase, walking up the monetary ladder only to finally reach it.

Practice delayed gratification:

- Stop for 48 hours before making non-essential purchases

- Pay yourself automatically before you touch the money

- Create visual cues for your long-term goals

- Track progress toward financial milestones

- Reward yourself for achieving certain goals

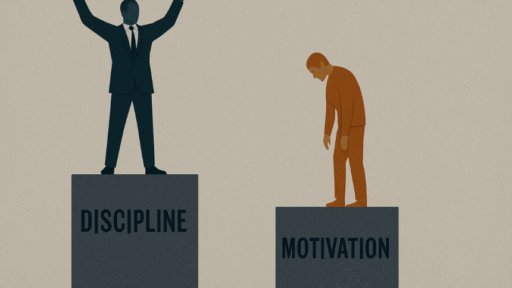

Shift #4: Fixed to Growth Orientation

With fixed mindsets, people believe their abilities are fixed. “I am bad with money” is continually injected to become an identity. The financial freedom mindset is growth-oriented—every skill can be learned, every mistake teaches us something important.

This change is transformative because financial literacy is not inherited. No one was born understanding compound interest, tax strategies or investment portfolios. Wealthy individuals figure these things out, mostly by trial and error.

Adopt growth thinking:

- Swap “I can’t” for “I haven’t learned yet”

- Study financial success stories

- Be open about money mistakes

- Look for mentors with what you want

- Read books about money and how to build wealth

Shift #5: From Victim to Victor

Maybe the most important change is assuming full responsibility for your financial future. Yes, outside forces are significant — the economy, your starting point, systemic obstacles. But the mindset of financial freedom is about what you do with what you can control, not what you can’t.

Victim mentality sounds like:

- “The system is working against me”

- “I’ll never get ahead”

- “I didn’t have the advantages that rich people had”

- “It’s too late for me”

- “My family never had money”

Victor mentality sounds like:

- “What can I control in this situation?”

- “What’s my next best move?”

- “Who has overcome similar obstacles?”

- “What can I learn from this setback?”

- “I create my own opportunities”

The Daily Practices That Rewire Your Financial Brain

One article won’t give you the mindset shifts or one seminar. Any new links in the brain require regular practice to become part of muscle memory. Over time, these daily habits rewire your brain.

Morning Money Visualization (5 minutes)

Each morning, imagine your financial goals as already completed. Picture yourself: Smiling when you check your bank balance, living in the home you desire or working because you want to and not because you have to.

Visualization is not just wishful thinking — it’s mental rehearsal. Athletes leverage it to enhance performance, and you can use it to fortify financial habits. Your mind doesn’t know the difference between a vividly imagined experience and an actual one, so this exercise creates neural pathways that reinforce wealth-building behaviors.

Gratitude Journal: Attract Money & Financial Abundance (3 minutes)

Every day, write down three financial things you are thankful for. This can be uncomfortable at first, especially if you’re short on cash. Start small:

- “I’m thankful I’ve had some food today”

- “I appreciate the $10 I put aside this week”

- “At least my car still runs”

Gratitude rewires your brain from the negativity of scarcity to a wealth abundance mindset. It teaches your attention to focus on what’s working instead of harping on problems. This gradually reorients your main thought patterns from scarcity to abundance.

Positive Money Affirmations (2 minutes)

Affirmations operate in tandem with actions and beliefs. Select 3-5 statements that are in line with your financial objectives:

- “Abundance comes to me easily and effortlessly”

- “I make smart financial decisions”

- “I deserve to have money”

- “I create value and I give out value”

- “My wealth is increasing by the day”

Repeat the following phrases with confidence. Experience emotions as if these are truths. Keep repeating them until they are your reflex thoughts.

Evening Financial Review (5 minutes)

Before you go to sleep, think about the financial choices that you made in the course of a day. Did you spend mindfully? Did you get closer to your goals? What will you do differently tomorrow?

This isn’t a question of judgment or blame — it’s about awareness. You can’t shift patterns if you are not aware of them. Keeping your mindset for financial freedom active and engaged on a daily basis is a quick daily review.

Tactical Approaches to Reinforcing Your New Mindset

Mindset work requires actionable approaches to move the needle in a tangible way. These strategies complement your mindset shifts to create real wealth.

The 50/30/20 Rule, With a Twist

Under the classic 50/30/20 budget, half is earmarked for needs, 30% for wants and 20% for savings. The financial freedom mindset version tweaks this to 50/20/30 — decrease your wants amount to 20%, and allow for more savings/investing with that extra 10%.

That puts you in the position of having to choose future security over present comfort — which is basically one definition of a freedom philosophy. Keep those percentages as your income grows, so lifestyle inflation doesn’t rob you of the progress.

The Opportunity Fund

Start to build an opportunity savings account on the side. When you catch wind of a potential investment, business idea or learning opportunity, you can spend your resources to capitalize on it.

This fund serves two purposes:

- Practical: You can be opportunistic without sabotaging your budget

- Psychological: Having “opportunity money” in your back pocket helps you learn how to see and think about opportunities

Start small — even $25 per paycheck adds up in this fund over time.

New to money management? Don’t miss this beginner’s guide to long-term financial success.

Income Diversification Projects

The financial freedom mentality isn’t about that one source of income. Begin to build revenue streams, even tiny ones, so you don’t live in fear at month end.

Options include:

- Freelancing your skills

- Creating digital products

- Starting a side business

- Investing in dividend stocks

- Renting assets you own

Having multiple income sources alleviates fear of losing one (or all) of them, and thus you are able to think more abundantly. They also impart important lessons about creating value and managing money.

Financial Education Time Blocks

Dedicate 30 minutes a day to financial education. Read books about money, listen to podcasts or watch educational videos about money management, study successful investors.

Treat it as a non-negotiable appointment. What you can earn is determined by what you know about money. People with money study it, make better decisions with it and reach a level of financial comfort that compounds over time into serious wealth.

Common Psychological Pitfalls That Limit Financial Success

And of course, with the best intentions in the world, this old programming will try to sweep in and muscle its way back into control. Look for these common traps that draw people back into scarcity thinking.

The Perfectionism Trap

Holding out for that perfect investment, the perfectly conceived business idea or the “perfect moment to start” will keep you stuck. The financial freedom mindset values action and learning more than perfection.

Start messy. Make mistakes. Adjust as you go. Every rich person has a long line of failures in their history — the only thing is they’ve kept going.

The Comparison Trap

Social media is the reel of everyone’s highlight, and all the doors we see opening can make us feel behind. And, comparing your Chapter 3 to someone else’s Chapter 20 kills motivation and creates artificial scarcity.

You only compare with yourself. Have you attained more financial literacy from last year? If you compared your financial habits now to what they were like six months ago, would you say that they are better? That’s the only kind of progress that really matters.

The Lottery Mindset

Some reprogram for abundance by anticipating windfalls — an inheritance, a lottery win, a sudden lucky break. This is simply scarcity thinking dressed up.

The process or mindset that creates wealth is one of achieving financial freedom one action at a time. Yes, opportunities do emerge, but most of them go to those who have prepared with the help of education and skill-building and smart money management.

The Sacrifice Myth

So many journey to financial freedom with a level of extreme frugality that is never sustainable. You slice every joy from life, burn out and then rebound to overspend.

The freedom mindset has balance. Yes, delayed gratification matters. But so does living in the present. This is spending with intention on what truly matters, not a downward spiral of waste-spending on afterthoughts.

Your 30-Day Financial Mindset Reboot

True change comes with consistent practice. You get a template for how to reprogram your money mindset with this plan over 30 days.

Week 1: Awareness and Assessment

- Days 1–3: Keep a journal, tracking every dollar you spend and how you feel about it

- Days 4-5: List all your money beliefs, good and bad

- Days 6-7: List three limiting beliefs to challenge this month

Week 2: Building New Patterns

- Days 8-10: Introduce morning visualization and evening review exercises

- Days 11-12: Select your money affirmations and start repeating them daily

- Days 13-14: Open your opportunity fund and make your first deposit

Week 3: Learning and Action

- Days 15-17: Read a wealth building or financial freedom book

- Days 18-20: Look into a side-income stream to pursue

- Day 21: Rework, revise and revamp your budget according to what really is important in life

Week 4: Integration and Momentum

- Days 22-24: Begin a financial education habit (podcasts, books, seminars etc)

- Days 25-27: Do one specific thing to work toward a financial goal

- Days 28-30: Think about how your thinking has changed and plan the next 30 days

The Power of Small Positive Changes in Thinking

Tiny shifts add up to huge results over the long haul. That 1 percent might not sound sexy, but if achieved consistently over years and decades through smarter investment and spending choices, it can compound to create for you the kind of wealth most people only dream about.

Think of it this way: If you were able to set aside $500 a month, starting at 25 with an average annual return of 8 percent, you would have more than $1.7 million by age 65. Make that investment at 35, and you have just $745,000. The difference? Ten years of compounding — $240,000 in contributions yielding an additional million dollars.

It’s the money mindset that knows these numbers and makes decisions early on, the payoff of which is exponential later. It prizes patience, discipline and long-term over short-term thinking, quick wins and instant gratification.

For more insights on building wealth through smart financial habits, check out Investopedia’s guide to personal finance.

Your Money Story Starts Today

Financial freedom is not just about having enough money to pay bills and retire comfortably. It’s about being able to choose — work that you love, time with people who matter and a life governed by values instead of the inevitable financial corner-cutting.

It’s all a result of the financial freedom mindset. It shifts your approach to money from reactive and stressful to strategic and empowered. And then you are no longer a victim of what’s going on in the marketplace; you are an architect of your own financial destiny.

Every rich person was there once, and probably with less than you have in your life at the moment. The distinction is not good fortune, inheritance or specialized advantages. The difference is thought — consistent thinking that results in consistent actions that yield consistent outcomes.

It all starts in the mind. Your money makeover starts with what you think. Change your mind, change your behavior. Change what you’re doing, change the results you get. Change your results, change your life.

It’s not a question about if one can train a freedom mentality. The real issue is whether you will practice every day as it takes to make it last. Your future self is counting on you and thanking you for getting started today.

Frequently Asked Questions

How long does it take to change your financial mindset?

The majority of people notice early changes in thinking after 2-4 weeks of daily practice. But, entrenched patterns can still take 6-12 months to shift completely. The secret is consistency — small changes you make every day lead to permanent change more quickly than once-in-a-while focus.

Can you develop the financial freedom mindset with a low income?

Absolutely. Financial freedom mindset is not a function of how much money you have today — it’s about the way you think about money regardless of your current realities. A lot of successful people began with nothing but a different state of mind. Just learn, create based on that learning, and decide from there with what you have available.

What is the No. 1 mistake people make when trying to change their money mindset?

The greatest mistake is separating mindset work from practical action. Your thinking at least needs to be tethered down to actual financial acts — budgeting, saving, investing, skill-building. Talk without action is delusion, not wealth. Add the mental aspect to tactical progress in your finances and you’ll get somewhere.

How can I stay in a financial freedom mindset when financial emergencies come up?

Emergencies test your mindset most. Get into the habit of viewing a setback as something that is temporary and solvable, not permanent and catastrophic. Ask “What can I control right now?” and “What do I do next?” Few things are more relaxing in a crisis than the peace of mind that comes with having an emergency fund, so building one should be a priority.

If I am older, is it too late for a financial freedom mindset to help me?

It’s never too late. And while the earlier you start the more that life’s most powerful financial tool — compound growth — can work in your favor, making a shift at any age can improve your financial situation. Individuals in their 50s and 60s have created great wealth through transforming their thoughts and actions. Concentrate on today’s possibilities rather than regretting yesterday’s limitations.

What should I do about those who don’t support my financial goals?

Be surrounded by people with your values, or who at least respect what you do. Your friends and relatives may not always be on board with your path to financial freedom, especially if it includes turning down social spending or working side gigs. Seek out communities — online or local — of people who have the same goals as you. Their encouragement can really help you to keep up with your new way of thinking.

What are the books or resources that can create a mindset of financial freedom?

These authors have created legendary books such as “The Millionaire Next Door” by Thomas Stanley, “Rich Dad Poor Dad” by Robert Kiyosaki, “Think and Grow Rich” by Napoleon Hill and “The Psychology of Money” by Morgan Housel who all addressed the mindset. Combine these with some practical financial books like “The Simple Path to Wealth” by JL Collins or “I Will Teach You to Be Rich” by Ramit Sethi for a well-rounded approach.